How Do Most People Draw Out Their 401k Distributions: Once A Year, Quarterly, Or Monthly?

What is a 401(yard) and How Exercise They Work?

A 401(k) is a retirement savings program sponsored by employers. You fund the account with coin from your paycheck, you can invest that coin in the stock market place, and you earn some tax perks for participating.

That's the basic (and slightly dull) definition of a 401(m). The more interesting angle is what a 401(k) can exercise for you. The 401(k) is a powerful resource for achieving financial independence, especially when you start using information technology early in your career. Said another fashion, if you like money and wish to accept more of it in the time to come, you can utilize a 401(grand) to make that happen.

Read on for a closer look at how the 401(k) works, when you lot can withdraw funds from a 401(k), and what happens to your 401(k) if y'all change jobs.

In this article:

- How a 401(k) works

- Contribution limits for 401(1000)s

- Withdrawing from your 401(k)

- What a 401(k) rollover is

How does a 401(k) work?

Eligibility to participate in your company 401(thousand) ordinarily involves a minimum employment period. Many employers permit y'all to participate in the 401(chiliad) within a calendar month or two of your hire date.

The amount yous deposit into your 401(k) with each paycheck is calculated from your contribution rate. Your contribution rate is the pct of your salary you will contribute. Say you make $45,000 annually, or $3,750 gross monthly. A 10% contribution rate would mean you contribute $375 from your monthly paycheck towards this retirement plan.

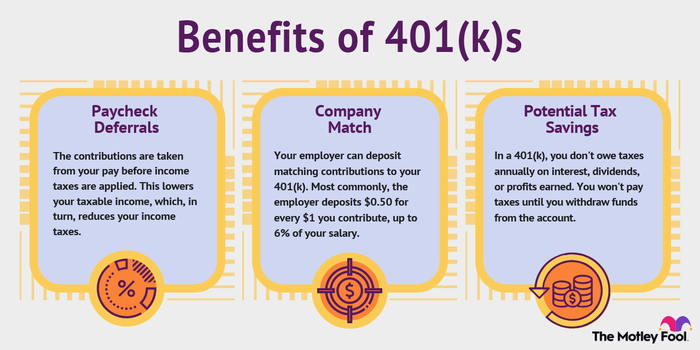

Don't panic if that seems like as well much money to carve out of your income. Thanks to the 401(m)'s taxation advantages, a $375 paycheck deferral will cost you something less than $375. The contributions from your paycheck are tax-deductible. Known as paycheck deferrals, these amounts are taken from your pay before income taxes are applied. That lowers your taxable income, which, in turn, reduces your income taxes.

Some 401(1000) plans offer matching contributions, also known every bit an employer match. These are deposits to your 401(k) business relationship that are funded by your employer -- basically free coin. Matching contributions follow a formula that your employer defines. A common structure is for the employer to eolith $0.50 for every $one you lot contribute, upwardly to vi% of your salary.

Those are just a couple of the rules for 401(grand). Yous also get tax-deferred investment earnings. Normally, y'all'd owe taxes annually on interest, dividends, and profits earned on investments yous've sold. You don't have to worry about any of that in a 401(one thousand). You can make as much as yous want on your 401(1000) investments and yous won't pay taxes until yous withdraw funds from the account.

Source: The Motley Fool

401(k) contribution limits

Even if you lot wanted to, you probably tin't put all of your paycheck into your 401(k). This is because the IRS sets limits on 401(yard) contributions. There are caps on how much you can contribute from your paycheck and on how much yous and your employer can contribute in full. The numbers tin can change from year to yr, just the limits for 2021 and 2022 are below.

- Y'all tin normally contribute upward to $20,500 ($19,500 in 2021) from your bacon to your 401(g). Exceptions apply to highly compensated employees, or HCEs.

- If yous are 50 or older, yous are allowed boosted paycheck deferrals of $6,500 per year. These are called catch-up contributions.

- Total contributions cannot exceed your pay, or $58,000, whichever is less. Total contributions include your paycheck deferrals, matching contributions, and any other employer-funded contributions.

- If you over contribute to your 401(k), brand sure to contact your program administrator.

- You can contribute to both a 401(k) and IRA or Roth IRA, but there are certain limitations.

The Roth choice

Some 401(yard)south allow you to make Roth contributions. A Roth 401(k) contribution has a dissimilar revenue enhancement structure than your standard 401(k) deposit. While the traditional 401(k) contribution is taxation-deductible up front and taxable when yous withdraw funds, the Roth contribution is the opposite. You get no taxation deduction for a Roth contribution, but your withdrawals in retirement are tax-gratis.

Withdrawing from your 401(k)

The 401(k) is intended to be a retirement plan, so withdrawals are restricted in your younger years. There are a few exceptions, but most withdrawals earlier age 59 i/2 come with a ten% penalization.

Retirement withdrawals: Y'all can beginning taking retirement withdrawals once yous've reached age 59 1/ii. You lot may be able to begin withdrawals at age 55 without penalty if you no longer work for the company. These withdrawals are taxed as ordinary income.

Required minimum distributions: If you lot don't need the money, you can leave information technology in the account until you are 72. In the first quarter of the year afterward you plough 72, the IRS requires you to take taxable withdrawals annually. These are known as required minimum distributions, or RMDs. The amount of your 401(yard) RMD for each year is based on your age and your year-end business relationship balance.

401(k) loan: Your plan may allow you lot to borrow against your 401(k) balance, which would not incur a penalty. Yous do pay interest on the loan; however, yous're paying interest to yourself. And, if y'all change jobs, you normally must repay the loan past the time your adjacent taxation render is due.

401(k) rollovers

Your job may not be a keeper, simply your 401(m) rest is. If yous change jobs, yous tin can have your retirement money with yous. Depending on your account residual, your sometime employer may fifty-fifty require you to take your funds out of the plan.

Either way, you'll want to do what's called a 401(k) rollover and then you can avert whatever taxes or penalties. There are two main types of rollovers:

- Direct rollover: You ask your program administrator to ship your funds directly to a different retirement account -- either an individual retirement account (IRA) or a 401(1000) plan with your new employer. No taxes are withheld from your funds.

- 60-day rollover: If your sometime employer sends your 401(k) funds to you directly, y'all have 60 days to eolith those rollover funds to an IRA or a different 401(thousand). This gets tricky considering your plan volition withhold xx% in taxes from the direct payment. Merely the amount you must deposit in a new account is the total account balance, including the withheld taxes. If you lot eolith a lesser corporeality, you will study the deviation as taxable income on your side by side tax return.

Hither's an example to clarify the 60-24-hour interval rollover. Say your 401(m) balance is $5,000 when you leave your job. Your employer sends you a bank check for $4,000, with $ane,000 withheld for taxes. You lot have threescore days to deposit the full $five,000 into another retirement account. If you deposit only the $iv,000 yous received, yous volition report $1,000 as taxable income. Y'all'd too owe a 10% penalty if information technology's an early on withdrawal.

401(thousand) for financial independence in retirement

The 401(k) makes it easy to build wealth for retirement. Once yous set your preferences, the work of saving and investing happens behind the scenes. Plus, you take tax savings and, possibly, matching contributions that expedite your savings momentum.

Hither's what it comes down to: The earlier you start contributing to a 401(grand), the more than you'll become from its benefits and the richer you can exist when you retire.

Retirement Plans

Cheque out other retirement plans that may be right for you

403(b)

Acquire most this retirement programme for teachers and non-profit employees

IRAs

Acquire the basics of individual retirement accounts.

Self-Employed Retirement Plans

Planning for retirement when you're your own boss.

FAQs

A 401(k) is a type of retirement programme offered by employers. It allows you to save for retirement using pre-tax dollars from your paycheck. Frequently employers volition match contributions up to a certain percent, allowing you to salvage even more. Then you pay taxes when yous withdrawal from the business relationship in retirement.

Yous may contribute up to $19,500 to a 401(thousand) in 2021 and $20,500 in 2022, unless y'all are age 50 or older, in which example you may brand an actress take hold of-up contribution of up to $6,500. These contribution limits can change yearly.

A Roth 401k plan is much the same equally a traditional 401(k) except contributions are made with later-tax dollars. Roth contributions don't reduce your taxable income for the electric current year but are distributed tax-complimentary in retirement. More on a 401(grand) vs Roth 401(1000)

More on 401(k)s

Source: https://www.fool.com/retirement/plans/401k/

Posted by: ortizziese1943.blogspot.com

0 Response to "How Do Most People Draw Out Their 401k Distributions: Once A Year, Quarterly, Or Monthly?"

Post a Comment